north dakota sales tax exemption

Whether you are looking for traditional tax incentives or innovative exemption opportunities North Dakota has a lot to offer. To apply for a sales tax exemption the taxpayer must submit a letter of application to the Office of State Tax Commissioner by email or mail.

Resale Certificate The Get Out Of Tax Free Card For Eligible Enterprises

Signed by new owner with tax exemption and lienholder information if applicable.

. How to use sales tax exemption certificates in North Dakota. North Dakota has a statewide sales tax rate of 5 which has been in place since 1935. Counties and cities can charge an additional local sales tax of up to 3 for a maximum possible combined sales tax of 8.

You can download a. I certify that I am an enrolled member of the following Indian Tribe. In North Dakota certain items may be exempt.

Sales TaxChurches in North Dakota. North Dakota Office of State Tax Commissioner. Groceries are exempt from the North Dakota sales tax.

A North Dakota resale certificate also commonly known as a resale license reseller permit reseller license and tax exemption certificate is a tax-exempt form that permits a business. No Sales Tax Exemption Available. Items shipped to North Dakota qualify for a tax.

Groceries are exempt from the North Dakota sales tax. In general North Dakota doesnt grant nonprofits sales tax exemption. The Community Development Loan Fund CDLF is available to businesses located in all cities and counties within the Region except the City of Bismarck for economic development.

The state government has instead written which kinds of organizations can qualify for state sales tax exemptions. A sales tax exemption certificate can be used by businesses or in some cases individuals who are making purchases that are exempt from the North Dakota sales tax. Counties and cities can charge an additional local sales tax of up to 3 for a maximum possible combined sales tax of.

Occasionally questions arise if churches are exempt from paying sales tax on purchases or if they are obligated to pay sales tax if they sell religious. Sales made to a tribal government are exempt from sales and use tax. This includes a tribal government agency that performs essential government functions.

Form NDW-R - Reciprocity Exemption from Withholding for Qualifying Minnesota and Montana Residents Working in North Dakota 2022 Individual Income Tax Form ND-1ES - 2022. Remote sellers with no physical presence in North Dakota are required to collect state and local sales tax on taxable sales made into North Dakota unless they qualify for the small seller. If vehicle is less than nine 9 years old SFN 18609 Damage Disclosure Statement must be completed by.

In-State Sales Tax Exemption is NOT Available but. This claim for tax exemption is based on the following fact which I certify to be true. I the undersigned claim an exemption.

A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for. Municipal governments in North Dakota are also allowed to collect a local-option sales tax. 24 rows Sales Tax Exemptions in North Dakota.

Learn more about the variety of tax exemptions incentives.

Farm Residence Exemption Cass County Nd

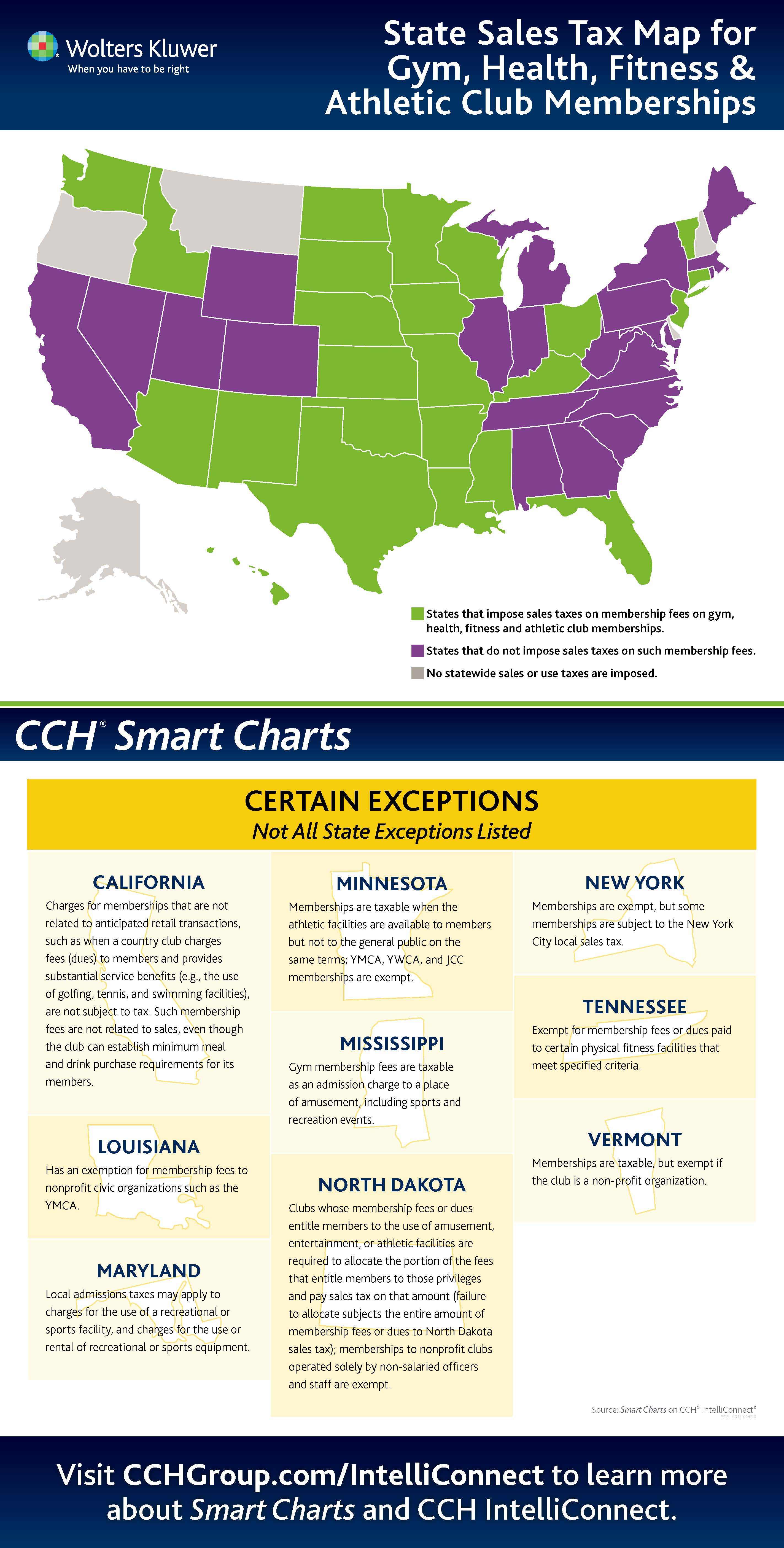

Media Alert Working Out At The Gym Really Can Be Taxing Depending On Where You Live Business Wire

North Dakota Sales Tax Exemptions Agile Consulting Group

North Dakota Sales Tax Exemptions Facilitate Disaster Relief Avalara

.png)

States Sales Taxes On Software Tax Foundation

Lidgerwood North Dakota Community Fact Survey North Dakota Histories Nd State Library Digital Horizons

Sales Taxes In The United States Wikipedia

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Printable North Dakota Sales Tax Exemption Certificates

Form 21999 Fillable Streamlined Sales And Use Tax Agreement Certificate Of Exemption

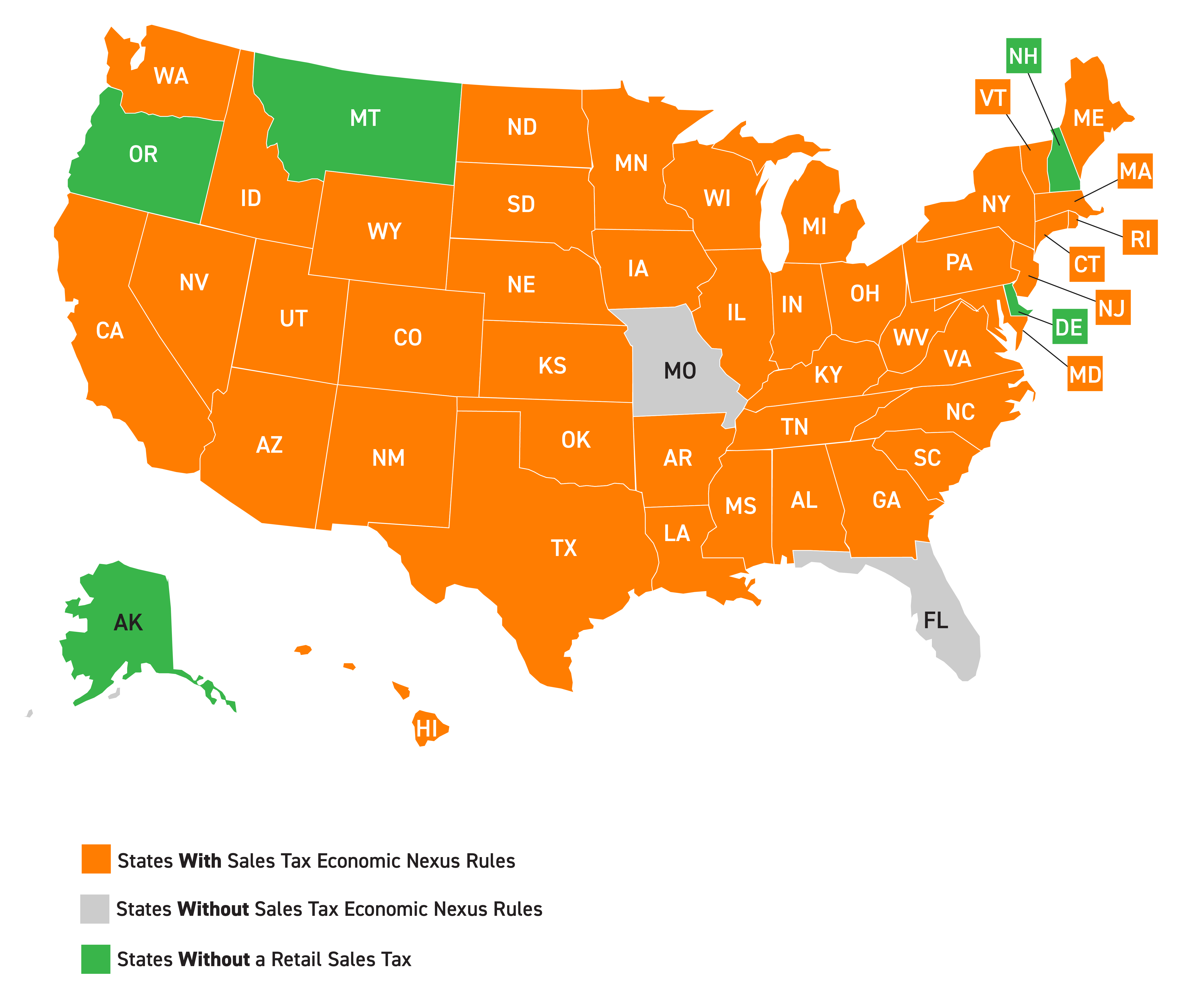

Growing Number Of State Sales Tax Jurisdictions Makes South Dakota V Wayfair That Much More Imperative Tax Foundation

Bill Of Sale Form North Dakota Tax Power Of Attorney Form Templates Fillable Printable Samples For Pdf Word Pdffiller

New Sales Tax Exemption In North Dakota Avalara

Sales Use Tax South Dakota Department Of Revenue

What Is A Sales Tax Exemption Certificate And How Do I Get One

North Dakota Solar Incentives Tax Credits For 2022 Leafscore

Welcome To The North Dakota Office Of State Tax Commissioner

Out Of State Sales Tax Compliance Is A New Fact Of Life For Small Businesses